I'm self-employed. Does that make me ineligible for employment insurance benefits?

With the growth of the gig economy in Canada, more workers are going the route of self-employment. For those willing to put in the time and effort, the possibilities are rich. If you’re a self-employed worker, or you’re considering going it alone, learn what to know and how to best protect yourself.

What you should know

“My photography business started out as a side gig. I’d get home from my office job and spend my evenings taking photos for my friends and family. Eventually, I was earning more from photography than I was from my day job. I decided to take the plunge — I incorporated my own company. Now I’m my own boss, doing work I’m truly passionate about.”

– Jerri, Richmond, BC

Self-employment is a type of work arrangement where you go into business for yourself. There’s no employer-employee relationship — you are your own boss. Self-employment generally means you get to decide what you want to work on, and who you want to work with.

There are many options when it comes to self-employment. For example, you could run a business on your own, or work on contracts for different clients. Some common terms used to describe self-employed workers include:

Freelancer. A type of contract worker with the freedom to choose who they offer their services to.

Entrepreneur. Someone who owns or operates their own business, usually taking on some financial risk.

Consultant. Someone who’s hired to provide expert advice in a particular field.

Independent contractor. A legal term used for tax and employment standards purposes.

Our guidance on alternative work arrangements more fully explores the options for self-employment.

The main law in BC that protects workers applies to “employees.” Self-employed workers (the law calls them independent contractors) aren’t covered. So unlike employees, independent contractors don’t have rights under this law. They aren’t entitled to vacation pay, for example, or job-protected leaves from work.

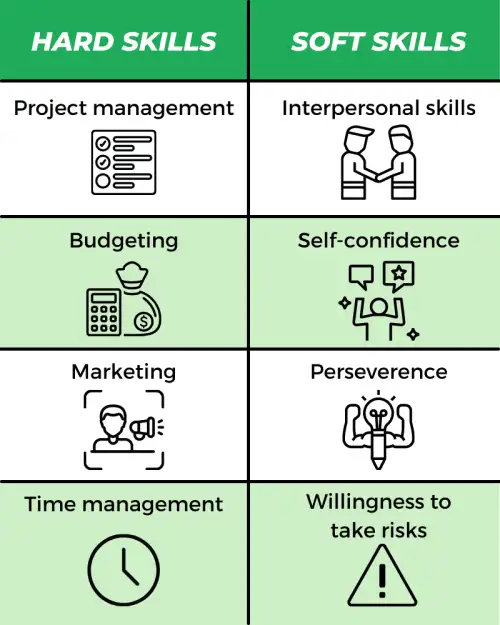

Not everyone’s cut out for self-employment. Certain personality traits and skills make success more likely. Here’s a list of some “hard” and “soft” skills that might make you a good candidate for going it alone.

You don’t need a business degree to earn a living as a self-employed worker. So much information is available online, you can likely learn all the necessary hard skills on your own. This is key, because when you start out you’ll likely handle most day-to-day business activities by yourself. Once things are up and running, you may be able to hire others to help you.

Soft skills are much more difficult to learn. You can develop them over time, but the road to success will be smoother if you’ve got them from the outset.

Give this self-assessment tool a try

The Business Development Bank of Canada is a financial institution devoted entirely to entrepreneurs. On their website, they have a self-assessment tool you can use to find out if you’re well-suited for an entrepreneurial career.

As an employee, there are certain financial obligations your employer takes care of for you. If you’re self-employed, you need to handle them on your own. The three main ones are:

paying personal income tax on your business earnings

making contributions to the Canada Pension Plan (CPP)

paying employment insurance premiums (this one is voluntary)

Let’s look at each in turn.

You may have additional obligations

Depending on your industry, you may have obligations beyond the ones noted above. For example, you may need to be licensed. Or you may need to buy insurance to protect yourself from liability.

Personal income tax

When you’re an employee, your employer takes money from your pay cheque to cover your income tax owing. If they deduct the correct amount, your tax bill should be $0 at tax time. If they deduct too much (meaning you overpaid your taxes), you’ll get a refund from the government.

When you’re self-employed, you’re entirely responsible for paying your tax bill. That means you need to think ahead and set aside enough money in advance. (We touch on how to do this in the “Take action” section below.)

You only pay tax on your business earnings after deducting business expenses. So when you’re preparing your taxes, you get to subtract certain expenses from your total income for the year. That brings down your taxable income and your tax bill. The federal government lists some of the most common business expenses you can deduct.

There are other tax credits and deductions you can take advantage of as well. For example, you can claim some of your RRSP contributions as deductions.

CPP contributions

Every worker in Canada over age 18 who earns $3,500 or more per year must contribute to the Canada Pension Plan (CPP). Employees pay half their required contribution, with their employer paying the other half. Self-employed workers make the whole contribution themselves.

The amount you contribute is based on your net business income (after deducting expenses). It also depends on the current CPP rate set by the government. We offer more detail on this below in the “Take action” section.

EI premiums

Through employment insurance (EI), the government offers financial assistance to people who are without work. To qualify for benefits, you must have worked a certain number of hours in work covered by the EI program.

If you’re self-employed, you need to opt in to the EI program to qualify for benefits. In other words, the EI program is voluntary for self-employed workers. See the next section for more details.

Take action to protect yourself

Before you start working for yourself, it’s a good idea to create a business plan. This is a roadmap outlining your goals and how you plan to achieve them. It doesn’t need to be a long, complicated document. Rather, it should be simple, clear, and easy to follow.

A business plan has six key sections:

Executive summary. An overview of your business and your plans. Sometimes it’s easier to write this one last.

Opportunity. Describe the problem you’re solving, your target market, and your competitors.

Execution. Explain how you plan to take the opportunity you identified and turn it into a business.

Company and management. Describe your current team, and who you’ll need to hire.

Financial plan. Outline your sales forecast, projected cash flow, and balance sheet.

Appendices. Use this space for images or additional information.

If you’re self-employed, you don’t have the same legal rights as an employee. You must rely on general contract law to protect yourself. Accordingly, it’s important to ensure your contracts are comprehensive. That way, you can fall back on the terms of your agreement if something goes wrong.

Here are some key terms you should include in all of your contracts:

Services provided. A detailed description of the services you’ll provide. Include any milestones or interim deadlines you agree to meet.

Payment terms. The terms of payment, including the amount, timing, and steps you can take if you aren’t paid on time (including penalties for late payment). If you’re accepting a deposit or retainer, include a term on that.

Allowable expenses. Whether the client will reimburse you for any work-related expenses (for example, travel or meals).

Ending the contract. A framework for how the contract will come to an end. This should cover situations where the contract can be terminated early. It should also explain any notice requirements.

Check out our guidance on your employment contract for more.

When you’re self-employed, you’re responsible for paying your own income taxes and contributing to the Canada Pension Plan. You make these payments directly to the federal government at tax time. It’s important to plan ahead to ensure you have enough to pay your taxes and CPP contributions when they’re due.

Let’s look at how to estimate your tax bill and CPP contributions.

Estimating income taxes

As explained above under “What you should know,” self-employed workers pay income tax on their business income after deducting expenses. For example, say you earned $70,000 in business revenue last year. You paid $10,000 in business expenses and operating costs to generate that revenue. That leaves you with $60,000 in business income after expenses. This is the amount you pay tax on.

Your federal tax rate depends on the income bracket you fall into. The federal government’s website provides the current tax rates. The provincial government collects income tax from you as well. Provincial income tax rates are listed on the government’s website.

You can use this tax calculator to get a rough estimate of your income tax bill.

Put aside more than you think you'll need

It’s good to be conservative when putting aside money for income taxes. Try to save up more than you think you’ll need. That way, it’s less likely that you’ll end up owing more than you have put aside.

Estimating CPP contributions

The amount you contribute to the CPP depends on your business income after expenses. You pay a percentage of your income (as of 2020, the rate is 10.5% for self-employed workers), minus a basic exemption amount, up to a maximum amount. The federal government’s website provides the current CPP contribution rates and exemption amounts. Notice that for self-employed workers the rate is double what’s listed in the table. That’s because self-employed workers must pay the employer’s portion as well as their own.

So continuing with our example, say you earned $60,000 in business income after expenses in 2020. Subtract the basic exemption amount of $3,500 and you’re left with $56,500. Multiply that by the contribution rate of 10.5% and you get $5,932.50. Note, though, that this is above the maximum self-employed contribution for 2020 listed in the table. So in this case, you’d pay the maximum contribution amount of $5,796.

You can use this tax calculator to estimate your CPP contributions.

When you’re self-employed, contributing to the employment insurance (EI) program isn’t mandatory. You get to decide whether you think the added protection is worth it.

Note that self-employed workers aren’t eligible for EI regular benefits. They’re only eligible for EI special benefits (such as maternity and sickness benefits). The federal government’s website explains EI special benefits for self-employed workers.

Your EI premiums are based on a percentage of your insurable earnings. This is your business income after deducting expenses, but before accounting for income taxes and CPP contributions. EI premium rates change each year. For the current rate, see the federal government’s website.

Carrying on with our example, on a business income of $60,000 after expenses, your EI premiums would be $60,000 multiplied by the 2020 rate of 1.58%. That’s $948. Note that this exceeds the maximum employee premium for 2020. So you’d pay the maximum amount: $856.36.

You can use this EI calculator to estimate your premiums.

Common questions

Generally, the contract you entered into with the client will spell out your rights around getting paid. If the client hasn’t stuck to the terms of your agreement, they may be in breach of contract.

In this case, a good first step is to check the contract to see if it includes a term around dispute resolution. If it does, you can follow the process described in the contract to try to recover what you’re owed. Alternatively, you can start a legal action against the client. Lawsuits are expensive and time-consuming, so only consider this option if there’s a lot of money at stake.

Note that, in general, self-employed workers don’t have the same legal rights as “employees.” Where employees have rights under BC’s main employment standards law, most self-employed workers don’t. That includes certain rights around getting paid. If you’re unsure of whether or not you’re covered by employment standards law, see our guidance on the topic.

The general rule is that you can only deduct expenses you incur to earn business income. The expense must also be reasonable under the circumstances.

If you work from home, you can deduct a portion of your rent and utility bills as “business-use-of-home expenses.” You can also deduct a portion of phone and internet bills (reflecting the extent you use them for your work).

Visit the CRA’s website for a full list of deductible business expenses.

Who can help

Canada Business Network

A governmental group that provides services and information to small businesses across Canada.

Community Futures BC

Provides services, tools, and alternative financing to small- and medium-sized businesses in rural BC.

GoForth Institute

Creates easy-to-follow videos for people looking to start their own business in Canada.

Women's Enterprise Centre

A non-profit organization dedicated to helping BC women start, lead, and grow their own business.