If you keep a zero balance on your credit card, it will improve your credit score.

Your credit score can have a major impact on your life. A low score can make it hard to get a credit card, rent an apartment, or borrow money. Making simple changes to the way you manage your everyday expenses can make a big difference. Learn steps you can take to improve your credit score.

What you should know

Your credit report shows your history of paying bills and borrowing money. Two main agencies in Canada prepare credit reports, Equifax and TransUnion. (See our pages on ordering and taking charge of your credit report.)

The credit reporting agencies use mathematical formulas to convert the information they have about you into a credit score. This score, which is sometimes called your credit rating, can range from 300 to 900. A high score is good. It suggests you’re likely to pay your bills on time, and pay back money you’ve borrowed.

If your credit score is low, you may have trouble with things like getting a credit card, renting an apartment, or getting a loan. If your credit score dips below 650, you may find it hard to borrow money.

Your credit score is not part of your credit report. You can order your credit score from the two main credit reporting agencies:

There are also companies that provide your credit score for free.

"I’ve always had the habit of maxing out my credit card and paying it off little by little. I saw a financial advisor, who recommended keeping my balance down at around 30% of my credit limit. I’ve been following her advice. My credit score has gone up by 50 points."

– Charlene, Victoria, BC

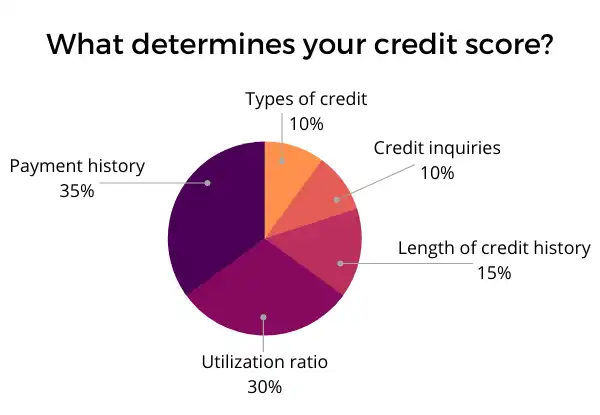

Credit reporting agencies don’t have to disclose how they calculate credit scores. The formulas they use consider many factors, and lenders may weigh those factors differently. As a result, your credit score might vary slightly from lender to lender, or depending on the credit reporting agency involved.

Generally, though, the following are important factors in determining your credit score. (Thanks to the Credit Counselling Society’s myMoneyCoach.ca for the factor weighting.)

Payment history (35%)

Your history of paying bills matters most to your credit score. Creditors want to be confident you’re going to pay them back. Making a late payment — or missing one altogether — will lower your credit score. Missing a $4 payment can be as bad as missing a $400 payment.

If a collection agency ever gets called in, your credit score will dip. Even if it’s only a single parking ticket you’ve neglected.

Your score also reflects when you last had issues with late payments or collection activities. The longer ago it happened, the less it will impact your score.

Your credit score will be lower if you’ve declared bankruptcy or had a court judgment against you in the last six years. Creditors take this as a red flag that lending money to you might be risky.

Utilization ratio (30%)

This figure shows how much of your total available credit you’re using. It compares your current balance to your credit limit. Let’s say the monthly limit on your credit card is $2,000. And you spend an average of $1,500 per month on the card. Your utilization ratio is 75%.

Creditors like to see a lower ratio. If you’re close to maxing out all of your credit cards or your line of credit (for example), it suggests to them there’s a decent chance you won’t keep up with your debt payments.

Generally, balances over 50% of your credit limit will lower your credit score. Going over a credit limit even once will also lower your credit score.

A higher credit limit could improve your credit score

Consider asking your bank or credit card company if they will increase your credit limit. A higher credit limit can lower your utilization ratio and improve your credit score — as long as you keep your balances at the same level. If you think a higher credit limit will tempt you to take on more debt, think twice before asking.

Length of credit history (15%)

This means how long your credit accounts have been active. Having a few long-standing accounts shows creditors you can manage your debts over time. This will improve your credit score.

Types of credit (10%)

Credit comes in many forms: personal loans, car loans, credit cards, lines of credit, cellphone contracts. It's good to have several different types of credit to show that you can handle your payments. A broader mix will improve your credit score.

Credit inquiries (10%)

This means someone has asked to see your credit report. If it’s because you’re asking for credit — or more credit — that’ll hurt your credit score. (For example, every time you apply for a new credit card, the credit card issuer will request a copy of your credit report. Their inquiry will lower your credit score.)

Other types of inquiries won’t hurt your credit score. For example, if you order a free copy of your credit report, your credit score will not be affected.

Under the law in BC, a bank, business, or other party must tell you in writing if it’s denying you something because of your credit score or information in your credit report.

For example:

a car dealer turns down your application for a car loan because your credit score is too low

a bank rejects your mortgage application because your credit report shows you’re carrying high balances on your credit cards

a landlord turns down your rental application because your credit report shows you’re often late paying your phone bill

In each case, the other party must tell you in writing they’re denying the request.

You have the right to ask which credit reporting agency issued the credit report your party is going by. But you must make this request in writing within 60 days of receiving notice.

Once you know which credit reporting agency supplied the report, you can request a free copy of the report to review it. See our page on ordering your credit report.

Being denied a loan or other application for credit won't appear on your credit report. Your credit report will show that you applied for credit, but not that you didn't get it.

Under the law in BC, a bank, business or other party must give you written notice if it plans to charge you more because of what your credit report turned up. For example, if a bank charges you a higher interest rate on a loan because of your low credit score, it must explain itself in writing.

You have the right to ask the other party which credit reporting agency it received your credit report from. You must make this request in writing within 60 days of receiving the written notice.

Once you know which credit reporting agency was involved, you can request from them a free copy of the credit report to review it. See our page on ordering your credit report.

There are businesses that claim they can help “repair” or “fix” your credit and improve your credit score. These companies often say they can scrub negative information from your credit report. Usually, they charge a monthly subscription fee for their trouble. But there’s nothing a credit repair company can legally do that you can’t do yourself.

All these companies do is review your credit report for mistakes. If they find any, they contact the creditor to fix them. In theory, this improves your credit score. But again, this is an easy step to take on your own. See our guidance on fixing a mistake in your credit report.

Some credit repair companies offer “credit building loans.” These are promised to quickly boost your credit score by showing creditors you’re trustworthy. But be careful. If you can’t make the loan payments, the credit repair company may send the loan to a collection agency — which would lower your credit score.

Consider getting a secured credit card instead

A better alternative to a credit building loan may be a secured credit card. A secured credit card requires you to put up cash, say $500, as security. If you don’t make your payments, the card issuer keeps that money you put up front. A benefit of these cards is that payments are reported to the credit reporting agencies, just as if it were a regular credit card. Cardholders who make regular payments and keep their balance low can improve their credit score.

Steps to improve your credit score

To improve your credit score, make a habit of reviewing your credit report. You’re entitled to a free copy of it once each year — see our page on ordering your credit report.

Here’s what to look for:

errors relating to payments, such as one you’re positive you made on time but is shown as late

negative information that’s more than six years old (this information should not be on your credit report)

unfamiliar accounts (this is a possible sign of identity theft)

If you spot anything on your credit report that shouldn't be there, see our guidance on fixing a mistake on your credit report.

Making your debt payments on time is the best thing you can do to improve your credit score.

Look into automatic payments

If you tend to lose track of when your bills are coming due, look into setting up automatic payments. Many creditors offer direct withdrawal from your account as your bills become due.

Generally, carrying balances below 50% of your credit limit is good credit hygiene.

If your balance climbs higher than that, bring it back down below 50% as soon as you can. Below 30% is even better.

About a month after you pay down your balances (and keep them there), your credit score should increase. That’s as long as you don’t have other negatives against you, like late payments.

Consolidating your debts means combining them into a single loan. This is sometimes called a consolidation loan. Usually, the interest rate will be lower than the average of the interest rates on your various debts.

A consolidation loan can improve your credit score by helping you pay your bills on time.

Putting up collateral may lower the interest rate on your loan

Creditors may offer you a better interest rate on a consolidation loan if you guarantee the debt with collateral. Collateral is something you can use as security for a loan. If you fail to pay back the money you borrowed, the creditor can take the collateral instead. For example, if you put up your car as collateral for a loan, and you don’t make your payments, the creditor can “seize” (that is, take) your car.

What if your credit score is low because you’re consistently having trouble managing your debts — maxing out your credit limits, paying late, or missing payments altogether? A credit counselling agency may be able to help.

A credit counsellor can:

combine all of your monthly payments into one monthly payment

negotiate a new payment plan with a creditor

negotiate a lower interest rate on your debt payments

Steps like these could help you pay your debts on time and shave down your account balances. Doing so will improve your credit score.

A credit counselling agency can also help teach you to:

manage your money

make financial decisions

make a budget and stay within it

The Credit Counselling Society of BC is one of the non-profit organizations working in this area.

Common questions

Yes. Even paying the debt in full after the due date will not remove the missed payment from your report. However, you won’t be saddled with that missed payment forever. After six years, it’ll be removed from your credit report. So when you review your report, make sure there are no missed payments there that are more than six years old.

Generally, negative information stays on your credit report for six years. If you were convicted of a crime in May 1999, for example, that fact should not be in your credit report.

One exception is an unpaid court judgment. A judgment is a debt you owe through the courts after a lawsuit. It can appear on your credit report until you pay it back.

Another exception is if you declare bankruptcy more than once. If you’ve declared bankruptcy two or more times, then a bankruptcy from more than six years ago can stay on your credit report.

A credit reporting agency may keep positive information, like payments made on time, in your credit report for longer than six years.

Not really. Creditors actually prefer you keep a small balance on your credit card so you continue to pay interest. Ideally, you should have some activity on your card but keep your balance below 30% of your credit limit. (Generally, balances over 50% will lower your credit score.)

No. In fact, cancelling a credit card could lower your credit score. The older your credit activity, the higher your credit score will be. Cancelling a credit card with a high credit limit can also hurt your utilization ratio. This will lower your credit score.

Instead of canceling your credit card, consider leaving the account open and carrying a small balance instead.

Who can help

Credit Counselling Society of BC

A non-profit society that helps people better manage their money and debt.