Life is unpredictable. At some point, illness or accident or age-related impairment may strike. Suddenly, you’re incapable of handling your affairs. How will your money be managed? How will bills get paid? Fortunately, there are tools you can put in place now in case you cannot manage your financial affairs and legal matters down the road. With each, we invite you to ask: Is this a good solution for me?

The two main financial and legal planning tools

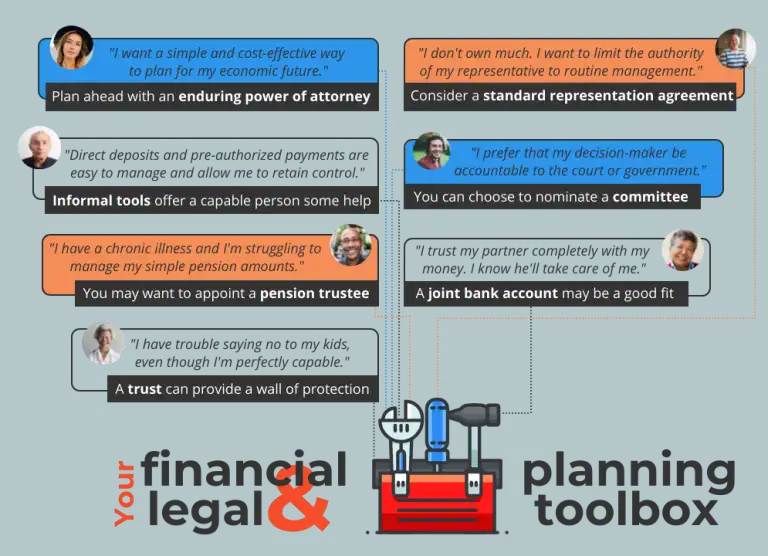

If you become incapable of managing your financial and legal affairs, no one, not even your spouse, has the automatic right to step in. So the beginning of a sound plan is to explicitly give someone the authority to act for you, if that’s ever needed. There are two main legal documents for this purpose: an enduring power of attorney and a standard representation agreement. We explain these two options shortly.

Your right to participate in decisions

The law says you have the right to participate in making life decisions, even once you become incapable. Your attorney or representative must encourage you to participate in your own affairs as much as you’re able to.

The tools we describe below can help you manage your future financial affairs and legal matters.

Financial affairs includes everyday decisions like paying bills, banking, applying for benefits, paying taxes, paying off loans, and applying for insurance. It can also include more complex decisions about money such as selling or buying a home, making investments, or taking out a loan.

Legal matters includes dealing with legal issues, instructing a lawyer, and getting legal advice and services.

“Last year, I found my wife Paige lying on the kitchen floor. She’d had a stroke. It was so sudden. Paige was smart with our money. A lot of it was tied up in investments — in her name. I was shocked the bank wouldn’t let me access her money. After all, I need the money to help to care for her. They said I didn’t have authority. I’m her wife — isn’t that enough? I wish we had talked about an enduring power of attorney when she was well.”

– Ramona, Surrey, BC

A power of attorney lets you name someone you trust to manage your financial affairs and legal matters. This often includes paying bills and managing bank accounts. It can include bigger things like investing your money, insuring your car, or selling your assets. The word attorney here doesn’t mean lawyer. It simply means your decision-maker.

With an enduring power of attorney, you can plan in advance for any future incapacity. This is one of the simplest and most powerful ways to plan for your financial future. Your attorney’s authority to act for you can start right away and then continue — or endure — if you are incapable.

You needn’t worry that drawing up a power of attorney will immediately strip you of the ability to run your own life. Your attorney can’t override decisions you make while you’re capable.

Values and beliefs

Sharing your attitudes about money with your attorney is an important part of planning that’s often overlooked. It’s one of the best ways to ensure your affairs will be managed the way you want. Nidus has a Values and Beliefs Discussion Guide you can use to help you get started. See the section on attitudes about finances.

Is this the right fit for me?

Enduring powers of attorney are:

Commonly used. They’re simple and relatively cheap to prepare.

Flexible. They can be as general or specific as you like and can cover financial situations from straightforward to complicated.

Far better than no document at all. If you lose your mental capacity and don’t have a valid document in place, the court may need to appoint someone to manage your money and property. This is expensive and time-consuming. And there’s no guarantee it’ll be the person you would have chosen.

Preparing an enduring power of attorney

The BC government has an enduring power of attorney form. You don’t have to use this form, but it will give you an idea of what goes into an enduring power of attorney. Meanwhile, we walk you through the steps of preparing an enduring power of attorney.

In some circumstances, you may opt to prepare a standard representation agreement instead of an enduring power of attorney. These agreements are often called section 7 representation agreements.

Your representative can deal with the routine management of financial affairs and most legal matters. For example, your representative can pay your bills, deposit your income, and purchase food for you. However, there are some things they can’t do. They can’t buy or sell your real property, for example, or take out a loan in your name. That makes this agreement less broad-reaching than an enduring power of attorney.

Is this the right fit for me?

Standard representation agreements are:

Often used as a last resort. They’re usually prepared when someone has no plans in place and is starting to show signs of incapacity.

Not always recognized. Representatives may find that third parties, such as banks, question the validity of their authority under the agreement. Powers of attorney are more commonly used by capable adults and more widely accepted by third parties.

Preparing a standard representation agreement

Standard representation agreements can also cover health care and personal care decisions. We explain representation agreements and how to prepare a standard representation agreement.

Other planning tools for financial and legal affairs

Other planning tools are available to you, in addition to choosing someone to make decisions for you.

You can start using some of these tools immediately. Not all of them will be appropriate for you — the combination of tools you choose will depend on your unique circumstances. Things like your physical and mental condition, family relationships, the complexity of your financial affairs, and your personal preferences all factor in.

There are other less formal tools that can be used. These arrangements make everyday life more convenient. You can put them in place right now, while you’re healthy.

You can arrange for your income to be directly deposited into your bank account. If you receive payments from the government (such as pension payments or income assistance), contact Service Canada and Service BC to set up direct deposits.

You can arrange pre-authorized payments with service providers. For example, you can tell your phone provider or your assisted-living facility to automatically withdraw what you owe them from your bank account.

You can authorize someone to help you deal with service providers, such as a utility company or Canada Revenue Agency. Be sure you understand what you’re authorizing.

Are these the right fit for me?

Informal planning tools can be used at different stages of life. They work for:

Healthy and capable adults. Routinizing your finances where you can just makes sense.

Adults who are capable but need help managing their everyday finances. These tools can be the least intrusive option and ensure the adult retains control and independence.

Anyone planning for future incapacity. Once incapacity sets in, these tools have limited use. Use of these as the only incapacity planning tools an adult has in place may be appropriate for those with a very simple financial situation.

“My husband passed away last year. He’s always taken care of the household finances for the both of us. I’m struggling to keep on top of managing expenses. I’ve set up a joint bank account with my daughter. She has a lot more experience with handling money than me and I trust her completely. I also want her to receive the money in the account when I pass away."

– Mabel, Golden, BC

With a joint bank account, two or more people have access to the same account. This may be a good option if you have someone in mind you can trust. Joint bank accounts usually include the “right of survivorship.” This means that if one of the account holders dies, everything that’s left in the account automatically goes to the survivor.

While these features offer convenience and flexibility, they also involve greater risk. For example, the other person can withdraw money without your consent or knowledge. Legally, it’s hard to hold a joint account holder responsible for taking money they weren’t supposed to.

Not all joint bank accounts are the same. A joint account might be able to be set up so there’s no right of survivorship (so that the money goes into your estate when you die rather than to the joint account holder). Do your research. Make sure you know what you’re signing up to!

Is this the right fit for me?

Joint bank accounts may be helpful for capable adults who need support. For example, adults:

Who find it difficult to manage their own personal banking. This could be due to health conditions, mobility issues or age.

With limited financial literacy or experience.

Using a joint bank account as a tool to plan for future incapacity may make sense if you have a simple financial situation and someone you can trust. Remember, the joint account holder will have access to all of your money when you’re most vulnerable.

“My adult son lives in my basement rent-free. He works on and off, but he asks me to pay for a lot of his expenses. I feel guilty saying no to him, but I’m retired now and am realizing he is quickly draining my finances dry. I want to set up a trust so a middleman can say ‘no’ instead of me. I love him but we can’t continue like this.”

– Basil, North Vancouver, BC

You can put all your property and income in a trust. In a trust agreement, you name a trustee and spell out how they should manage your property.

There are several reasons why people use trusts:

A trust agreement can maintain private and secure control of your assets.

Trusts can be especially useful in circumstances where you’re vulnerable. A trust can provide a “wall of protection” for your assets, even while you’re capable. Your trustee can say “no” on your behalf to someone who’s trying to take advantage of you. And a trust can continue if you become incapable.

A trust agreement can provide more comprehensive terms of the trustee’s duties and powers than an enduring power of attorney. This can include a framework for management of property.

A trust can be used to manage your property after you die. For example, a trust can ensure that your surviving spouse has enough money and a place to live. Once your spouse passes away, you can use the trust to pass the remaining funds to your children.

Is this the right fit for me?

A trust can be useful for a capable adult:

Who is vulnerable. Some adults have family members, friends or others in their lives who are aggressively needy.

Who recognizes they can’t say no to others.

With limited financial literacy. People will little experience managing their own money can have a loved one set up a trust for them.

A trust can be used as a planning tool for future incapacity. It’s an alternative to preparing an enduring power of attorney. Be aware that it’s likely more expensive to set up than an enduring power of attorney.

Preparing a trust

If you think a trust could work for you, speak with a legal professional. They can advise you on your options and help you draft the trust agreement. Here are some free or low-cost options for legal advice.

If you’re mentally capable but struggling to manage your money (for example, because you’re physically unwell, have a mental illness, or are homeless), you can appoint a pension trustee. A pension trustee can be a person you trust or an organization. They can collect and manage Old Age Security, Guaranteed Income Supplement, and Canada Pension Plan payments on your behalf. They can’t manage other assets. Service Canada can assist with the process.

Is this the right fit for me?

A pension trusteeship may be a good fit for you if all of the following apply:

You have pension income only. That is, income only from federal income security programs such as Old Age Security and Canada Pension Plan.

You have no other assets.

You have simple expenses. Just the basics, such as rent, food and utilities.

Appointing a pension trustee

If someone’s already mentally incapable, a pension trustee can be appointed for them. It’s a less expensive route than appointing a committee, if you only receive federal pensions.

If you were to become incapable and you’d neglected to put an authority in place, someone may need to apply to the court to make decisions for you. This involves asking the court to appoint them to be your committee of estate. This is usually necessary when a major or complex legal or financial decision or action needs to be made on someone’s behalf and a power of attorney isn’t in place. A committee of estate has broad powers to make financial and legal decisions for you.

While you’re still legally capable, you can nominate a particular person to be your committee. Be aware that obtaining committeeship is the most intrusive planning option. Legally, you lose your decision-making rights. It’s also an expensive and time-consuming process.

Is this the right fit for me?

Nominating a committee may work for you if you have someone you trust who you believe could represent your interests well, and:

you prefer that your decision-maker is appointed by the court (a committee of estate must provide ongoing accounts to the court or to the Public Guardian and Trustee), and

you think there could be family conflict if a committee ever needed to be appointed.

Nominating a committee

When you nominate a committee, you’re not appointing someone as your committee. It’s simply a way of informing the court of your preference. If it later becomes necessary that one be appointed, the court must honour your choice unless there’s a good reason not to.

Common questions

One way to protect yourself is to consider using a monitor. A monitor is someone appointed to review other people’s actions in your accounts. Think of the monitor as a watchdog. They can inform the Public Guardian and Trustee if someone’s acting improperly.

Monitors are used in representation agreements if a representative deals with money. You can also consider appointing a monitor under an enduring power of attorney or if you hold a joint bank account with another person.

The planning tools we describe above are ways you can handle your financial and legal affairs while you are alive. A will says what happens to your money and things after you die. Our coverage of preparing a will has more.

It’s still important to plan. Otherwise, there may be no one around to help you with everyday finances when you need that help most.

If your finances are very simple, there are some informal tools — such as direct deposit of bill payments — you can use. Or you can pay a professional to manage your affairs. It’s worth speaking to a lawyer about your best options. For example, if you have a meaningful amount of wealth, you could consider setting up a trust so your money can be managed for you by a trustee if you become incapable. We explain these kinds of options above.

Consider connecting with community groups and resources now to find social support within your local community.

You should. Planning for your future is about having a say in what happens in your life. It’s not just about taking care of the people in your life.

No one financial tool is right for everybody. The combination of tools you choose to use, and how you use each tool, will be influenced by factors like your physical and mental condition, as well as family relationships, the complexity of your financial affairs, and of course your personal preferences.

Under each tool we’ve described, you’re prompted to ask yourself: is this tool the right fit for me? You can re-visit the description of each tool and consider how it might apply in your situation.

Who can help

Nidus Personal Planning Resource Centre & Registry

Detailed information on personal planning, including template forms.