Can I open a bank account even if I don't have any money to put into it?

Opening a bank account is a key step in taking control of your financial situation. There are many types of accounts out there; it’s worth taking the time to choose one that’s a good fit. Learn your rights and the steps to open a bank account.

What you should know

“For my daughter’s twelfth birthday, we opened a youth bank account for her. I’m a firm believer in getting an early start on this stuff. Now she’s putting aside some of her weekly allowance as savings, and we couldn’t be more proud!”

– Parveen, Coquitlam, BC

In Canada, you have a right to open an account at a bank or credit union, with a few narrow exceptions that we explain below.

You can open a bank account even if you:

don’t have a job,

don’t have money to put in the account right away, or

have been bankrupt.

To open an account, you generally need to go to a physical branch of the financial institution. (Some allow you to open an account online.) You must show proper identification.

What is acceptable identification?

There are three different combinations of accepted identification you may show:

two government documents that prove who you are, such as your passport, driver’s licence, or birth certificate

one government document that proves who you are, along with one approved non-government source of identification such as a credit card or employee ID card

one government document that proves who you are, and have someone in good standing with the financial institution or in the community confirm your identity

You may be asked to provide your social insurance number

Financial institutions must ask for your social insurance number (SIN) if you’re opening an account that will earn interest — such as an interest-bearing savings account, or an RRSP.

The financial institution must give your information to the Canada Revenue Agency. It must report the interest earned on the account each year for income tax purposes.

If the financial institution wants to use your SIN for anything else, it needs your written consent.

When you open a bank account, the financial institution must give you information about the account.

This information includes:

the interest rate you’ll earn (in the case of an interest bearing account)

how any interest will be calculated

details of all charges related to the account

how you'll be contacted about any increase in charges or any new charges

details of the institution’s process for handling complaints

In some circumstances, you can choose to receive this information either in print or electronically. The information must be in clear language and not misleading.

You must get a copy of the account agreement within seven business days of opening the account.

Make sure you fully understand the agreement

Make sure you understand all the information the financial institution gives you. When you open a bank account, you’re entering into a contract with the institution. If anything’s not clear, ask. Keep a copy of the account agreement for your records.

You have the right to close the bank account, without cost, within 14 business days of opening it. You just need to phone the financial institution and tell them.

If you choose to close the account, the institution must refund any charges relating to the account.

A financial institution can refuse to open a bank account for you if they believe:

you plan to use it to break the law

you gave false information when applying for the account

you might harm or harass other customers or its employees

As well, they can refuse to open an account if:

you’ve committed a crime against a financial institution in the last seven years

you don’t allow the institution to verify if the circumstances above apply to you or to verify your pieces of identification

If a financial institution refuses to open a bank account for you, it must:

tell you in writing

give you contact details for the Financial Consumer Agency of Canada

You may also tell the financial institution that you want to make a complaint. (All banks must have a process in place for handling customer complaints.) For the steps to take in making a complaint, see our guidance on using your bank account.

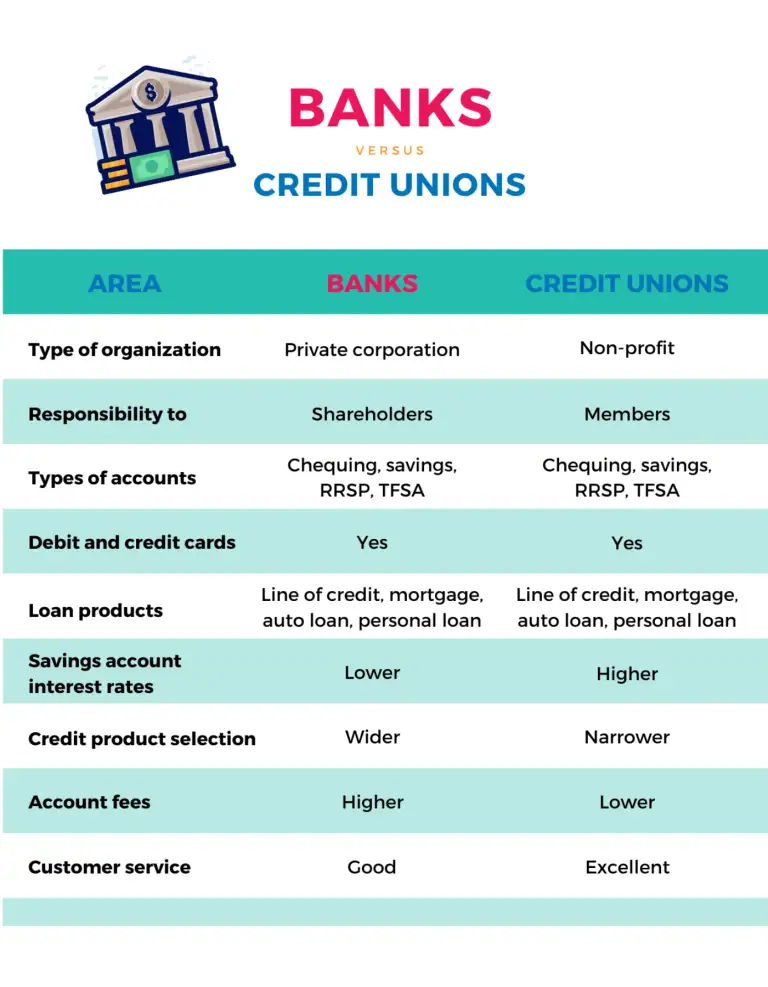

Shopping around for an account, you can choose a credit union or a bank.

A credit union is a non-profit owned by its members. Most credit unions are regulated by the province. A bank is a business owned by shareholders. Banks are regulated by the federal government.

Here are some of the key similarities and differences between the two.

Some provincial credit unions may have restrictions on who can join. For example, they may require you to live, work, or attend school in the area they serve. You must meet the eligibility criteria and buy a share to become a member. (They’re not expensive.)

Like banks, most credit unions have physical locations and ATMs. But there aren’t nearly as many of them. Keep that in mind if convenience is important to you.

Another downside to credit unions is that they generally have a limited web presence. Most banks offer comprehensive online banking services through a website or mobile app. Some credit unions offer such services, but they usually come with fewer features and are less robust.

You can open a bank account jointly with other people. You might want to do this, for example, to manage household bills with your partner or someone you live with.

A joint account allows two or more people to access it. Either of you can make deposits, withdrawals, and payments from the account. You're also responsible for any transactions made by the other person. So if the other account holder withdraws more money than is in the account, you may be responsible for repaying the money.

Ask about the right of survivorship

Ask a representative of your financial institution if your joint account includes the right of survivorship. This means that when one account holder dies, the survivor becomes the sole owner of the account.

Low-cost accounts (also called basic banking accounts) are available for $4 per month. At minimum, these accounts include the following services:

at least 12 debit transactions per month

ability to write cheques

a debit card

unlimited deposits

monthly printed statements

ability to set up pre-authorized payments

cheque image return or online cheque image viewing

Low-cost accounts are available at no cost to:

youth

students

seniors getting the guaranteed income supplement

registered disability savings plan beneficiaries

Contact your financial institution to find out if they offer low-cost or no cost bank accounts.

Open a bank account

Bank accounts come in a variety of flavours to help people manage their money. When opening an account, think about the services you need for both your day-to-day banking and long-term financial needs. Choosing the right service plan can save you time and money.

For example, say you conduct upwards of 30 transactions — transfers, withdrawals, debit card purchases, bill payments — every month. Look for a service package that lets you make multiple transactions for a flat fee. If you need other services like certified cheques, money drafts, overdraft protection or cheque return, there are packages that include these as well.

Try an account selector tool

Check out the Financial Consumer Agency of Canada’s account selector tool. It can help you compare different accounts to find the one that suits you best.

Research banks and credit unions in your area. Find out the types of services they offer, and what their rates are.

After mulling your options, you may decide you’re better off with more than one bank. This can give you more flexibility and access to a bigger range of products and services.

Read through any account agreement carefully before you sign. Make sure you understand all the terms, conditions, and fees for the account. Ask questions about anything you don’t understand.

Once you understand the account agreement and you’re happy with your decision, sign the agreement. Make sure the financial institution gives you the information you’re entitled to (see above).

Keep a copy of the account agreement for your records.

Remember, if you change your mind, you have the right to close the account within 14 days of signing.

Who can help

Financial Consumer Agency of Canada

Deals with complaints against federally-regulated banks and trust companies.

Ombudsman for Banking Services and Investments

Investigates complaints about banking matters involving most banks and credit unions in Canada.